We didn't start the fire

It was always burning, since the world's been turning

We didn't start the fire

No, we didn't light it, but we tried to fight it. Billy Joel

I’ve always been interested in the question of who actually started the fire, but for me, it meant more about where we came from as a species and where we are going in the fullness of time. When you step back, and especially if you’ve actually studied our species, it seems silly to ignore 99% of our evolution. Those of us who work in the financial markets rarely think in this fashion, living as we do in a rather strange universe characterized by information overload and myopic viewpoints. While the ‘long view’ is one that apparently everyone takes, it is one that no one actually practices - particularly as algorithms driven by quantitative trading increasingly drive the flows in and out of sectors and the companies within them. The ‘long view’ or 'macro’ tends to be, at best, guesses on the next recession, or at worst, the hated ‘day trade’ (hated because day traders don’t pay for guesses bundled as 'research’).

In fact, the ‘long view’ in finance is akin to searching for Bigfoot – a lot of talk, but scant evidence. The common collective horizon? A whopping 12 months – conveniently timed with our annual performance bonuses - as if the universe revolves around our financial brilliance. Yet no one I speak with, investors, companies, or consultants—seems particularly satisfied with this situation. Plenty of posture on long termism but painfully little evidence.

Sadly, for this comfortable market soiree, problems that play out in geological time don’t tend to play nice forever. Whether climate change or biodiversity, these pesky issues don’t tend to wrap up nicely at year end so messing with them probably won’t hit your bonus this year.

ESG emerged over 20 years ago as a force in its own right, but squarely within the prevailing market ideology. Progressive thinkers have largely turned into tinkerers, playing nicely in their own sandboxes while portfolio managers get on with making ‘bank’. The big issues – like how 2.8 billion people still cook using unsafe fuels today - or why we still slaughter other species after eons of much lauded ‘progress’ - seem altogether beyond the grasp of markets. And no wonder, as modern markets remain fully embedded in the concept of exceptionalism - where a few reap most of the gains and nature takes all of the pain.

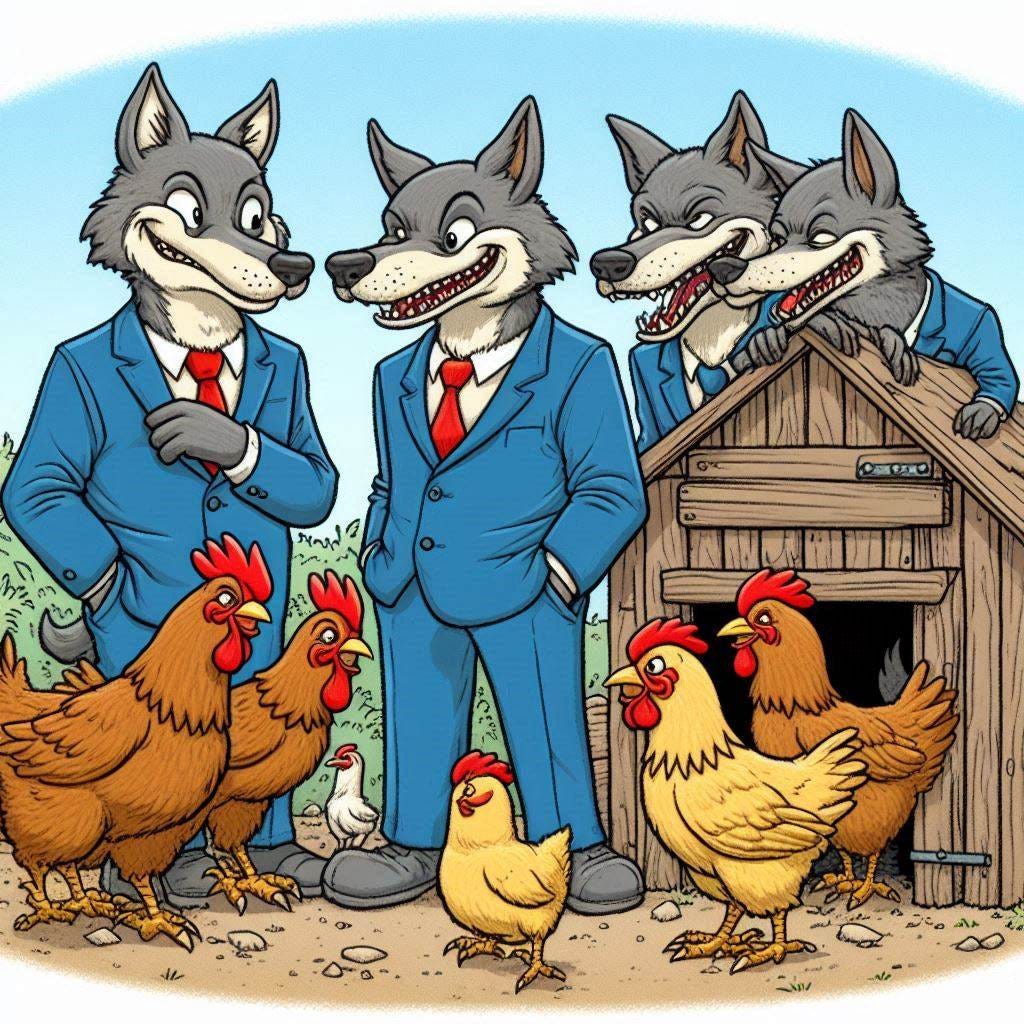

Despite the obvious limitations, the financial sector is often lauded for its all-seeing powers and now even as the guardian of a sustainable future. Is this adoration misplaced? Were we being naïve all those years ago? Did the ‘Wolves of Wall Street’ deserve the key to the hen house?

We have had the luxury of living in a pretty sweet period called the Holocene – a time of relative climate stability in a geological blender of dramatic events. This temperature stability allowed us to cultivate plants and domesticate animals, leading to pretty much everything we know as ‘civilization.’ Unfortunately, we’ve treated the Holocene lately like a disposable coffee cup – so much so that we may have entered our very own era, the ‘Anthropocene’ - or better known as ‘let’s roll the dice and see what happens.’ Amazingly, we’re content to play these games of roulette, fully aware of all those civilizations that ended badly during the comfort of the Holocene. In other words, a remarkable period of climatic stability - quite unlike what we are going to experience.

In this blog, we’ll look at our past – but think more ‘Quest for Fire’ than ‘Alexander the Great’. You have your high school history textbooks for that. We’ll dive deep into our prehistory when those in our family tree wondered who was next to go extinct. Why bother? Well, because our efforts at bending our culture to reflect our place on the planet seem like band-aids on a gunshot wound. And if they are not working, we should probably step back and try to understand. Oh, and because our recent hope that the financial markets will pull us out is likely seriously misplaced. It's not because there aren’t plenty of good intentions, instead, it's because it requires a profound reckoning with our cultural behaviors and beliefs about as much fun as that colonoscopy you’ve been putting off.

I’ll dissect how today’s market trends, from an obsession with growth, productivity, and cash flows, are embedded in the concept of fiduciary responsibility, ensuring that the markets cater to the financial needs of this, the ‘luckiest’ generation. By ‘lucky’ I mean if you live in the ‘West’ and walk on two feet. For everybody and everything else, the market’s obsession with a comfortable retirement doesn’t cut it.

Markets are a modern tool in the human toolbox, and they are good at one thing in particular - throwing money at the ‘next big thing’. The only problem is that, whether it's Amazon, Meta, or GenAI, the next big thing these days just consumes more and more energy and gets us to buy more and more stuff. This is in perfect alignment with our evolutionary past – as we will see in this blog, maximizing energy use is a bit of a human thing - which was all perfectly fine until the scale of our culture started to get too big for its ecological britches. The behavioral changes we need are massive, but, to be frank, talking about them won’t make you an influencer. If you don’t believe me, try posting about reducing consumption or relearning how to adapt to the weather and wait for the inevitable ghosting.

Just to set expectations, don’t expect this blog to be a fortune cookie. After nearly 25 years of wading through the murky waters of sustainability, I’m realizing that most wins involve some serious trade offs and that simple solutions are often better than overly complex ones. Do consider this blog a flashlight in the sustainable investing fog – shedding some light on the path forward while grounding it in our actual past. If you’re up for it, let the tragicomedy of human evolution, ecological boundaries, and market manipulation begin – but buckle up, it’s going to be a bumpy ride.